Jio Financial Services Limited (JFSL) has been one of the maximum talked-approximately agencies in the Indian stock market because of its listing. Investors are curious approximately Jio Finance’s share charge, its increased capability, and how it compares with other financial stocks. In this article, we can discover JFSL’s stock performance, historical developments, economic stability, and destiny possibilities.

Introduction to Jio Financial Services (JFSL)

Jio Financial Services Limited (JFSL) is a monetary offerings corporation that became demerged from Reliance Industries Limited (RIL). The goal behind this demerger changed into establishing robust financial offerings emblem that could recognise lending, wealth control, and insurance.

After its separation from Reliance, JFSL became indexed at the inventory exchanges, developing a brand-new investment opportunity for retail and institutional investors. The organisation’s robust, determined backing from Reliance has given it a competitive advantage in the financial area.

Jio Finance Share Price at the Time of Listing

Jio Financial Services Share Price Data

| Date | Open (₹) | High (₹) | Low (₹) | Close (₹) | Volume |

|---|---|---|---|---|---|

| April 2, 2025 | 230.99 | 230.99 | 225.30 | 229.78 | 16,203,186 |

| April 1, 2025 | 227.00 | 231.29 | 225.21 | 230.42 | 18,781,790 |

| March 28, 2025 | 227.18 | 232.30 | 226.11 | 227.51 | 30,356,334 |

| March 27, 2025 | 222.17 | 228.00 | 221.33 | 225.78 | 188,868,886 |

| March 26, 2025 | 228.00 | 228.90 | 222.01 | 222.67 | 19,372,538 |

When JFSL changed into indexed, its preliminary share charge changed into decided through a pre-open call public sale. The inventory debuted in the marketplace with a mean charge of ₹261.85 in keeping with proportion. However, the publish-list, skilled some fluctuations because of marketplace situations.

Key Highlights of Jio Finance Listing

- Listing Date: August 21, 2023

- Opening Price: ₹261.85

- Stock Exchanges: NSE and BSE

- Volatility: Prices fluctuated, to begin with, due to heavy trading interest

Many traders predicted sturdy performance from JFSL because of its connection with Reliance, however, marketplace volatility influenced its movement in the initial days.

Jio Finance Share Price Trends & Market Performance

Since its list, Jio Financial Services has long gone via multiple rate moves. The stock has proven periods of growth, corrections, and stability based totally on marketplace trends and company bulletins.

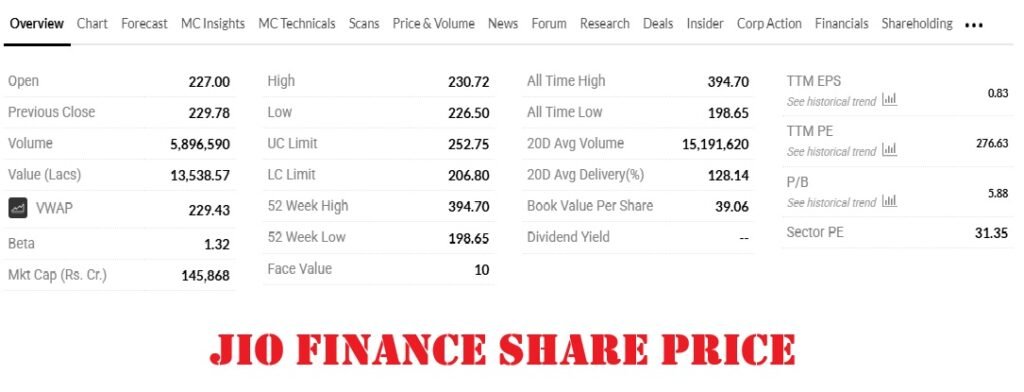

Jio Finance Share Price Trends

- fifty two-Week High: ₹394.70

- fifty two-Week Low: ₹198.65

- Current Market Price: ₹230.55 (as of April 2025)

This rate movement suggests that JFSL has long passed through America and downs, that is every day for newly indexed stocks.

Factors Affecting Jio Finance Share Price

- Market Sentiment – Positive or terrible information can impact stock fees.

- Financial Reports – Quarterly profits and sales boom affect investor confidence.

- Regulatory Changes – Government regulations related to economic services affect inventory performance.

- Investor Demand – Institutional shopping for and retail investor interest create fluctuations.

Financial Performance of Jio Finance

For investors, reading about an employer’s monetary health is crucial before making funding decisions. Let’s test JFSL’s financial highlights.

Jio Finance Financial Overview

Financial Metric Value Market Capitalization₹1.46lakh crore Debt Status Almost Debt-Free Revenue Growth Consistently Increasing Price-to-Book Ratio1.06

One of the maximum crucial components of JFSL’s financials is that it’s miles nearly debt-free, which makes it a low-danger investment in comparison to highly leveraged corporations.

Jio Finance Shareholding Pattern

Shareholding Pattern as of December 31, 2024

| Shareholder Category | Percentage (%) | Number of Shares |

|---|---|---|

| Promoters and Promoter Group | 47.12% | 2,99,38,87,366 |

| Public Shareholding | 52.88% | 3,35,92,54,257 |

| Foreign Institutional Investors (FIIs) | 15.62% | Data not specified |

| Domestic Institutional Investors (DIIs) | 12.56% | Data not specified |

| Retail and Others | 24.70% | Data not specified |

It is constantly crucial to check who holds the majority of shares in an agency. Below is the state-of-the-art shareholding sample of JFSL:

Shareholder Category Percentage of Holding Promoters (Reliance Industries)46.8%Foreign Institutional Investors (FIIs)21.2%Domestic Institutional Investors (DIIs)12.5% Retail & Other Investors19.5%

The reality that Reliance still holds a main stake (46.8%) in JFSL offers traders confidence in its lengthy-term stability.

Future Prospects of Jio Financial Services

JFSL is anticipated to develop considerably within the coming years due to its strong technological backing, marketplace reach, and enlargement plans. Some key growth drivers consist of:

- Expansion into Digital Lending – JFSL’s objectives are to use AI-based total credit fashions to simplify loans for consumers.

- Entry into Insurance & Wealth Management – The corporation plans to introduce Jio-branded monetary products.

- Strategic Partnerships – Collaborating with banks and NBFCs for monetary boom.

- Reliance Group’s Support – Benefiting from Reliance’s sturdy emblem call and infrastructure.

With these growth techniques, Jio Finance’s percentage charge could see an upward trend ultimately.

Investment Risks & Considerations

Investing in Jio Financial Services Limited (JFSL) comes with positive risks and elements that traders need to carefully compare. Understanding those dangers can help make knowledgeable decisions and reduce capacity losses.

1. Market Volatility

The stock market is rather unpredictable, and Jio Finance stocks are not an exception. Prices can differ because of marketplace sentiment, international monetary situations, and quarter-particular tendencies. Investors ought to be organized for quick-time period charge swings.

2. Regulatory & Policy Changes

Government regulations, RBI rules, and financial zone reforms can impact JFSL’s commercial enterprise operations. Any damaging adjustments in banking, lending, or virtual finance rules may additionally affect its sales and profitability.

3. Competition within the Financial Sector

The Indian financial market is fairly aggressive, with predominant players like Bajaj Finance, HDFC, and Tata Capital. JFSL ought to continually innovate to preserve an aggressive aspect. Increased opposition may also position strain on margins and consumer acquisition.

4. Economic Downturns & Inflation

Macroeconomic elements consisting of inflation, interest rate hikes, and monetary slowdowns can affect consumer spending and borrowing conduct, impacting Jio Financial Services’ loan disbursements and overall profitability.

5. Dependency on Reliance Ecosystem

JFSL is a part of the Reliance Industries atmosphere, which offers both blessings and risks. While Reliance’s strong backing gives monetary balance, any terrible traits in Reliance’s middle businesses could indirectly affect JFSL’s inventory overall performance.

6. Liquidity Risks

Being a distinctly newly indexed business enterprise, JFSL’s buying and selling extent might be decreased than mounted financial corporations. Lower liquidity can lead to higher bid-ask spreads and potential problems in executing big trades without affecting the percentage charge.

7. Cybersecurity & Digital Risks

As a tech-driven financial company, JFSL closely is based on digital platforms and online transactions. Cybersecurity threats, statistics breaches, or IT failures can affect customer acceptance as true and result in regulatory penalties.

Investors ought to continually analyse danger factors earlier than making investment selections.

Conclusion: Should You Invest in Jio Finance?

Jio Financial Services has shown robust capacity in its early days as a listed organisation. Its backing from Reliance, debt-loose status, and strategic financial plans make it an attractive investment opportunity. However, marketplace volatility and opposition should be taken into consideration before investing.

Final Thoughts on Jio Finance Share Price:

- Growth Potential – High, due to new financial services initiatives.

- Financial Stability – Strong, with no principal debts.

- Investment Suitability – Best for lengthy-time period traders.

- Risk Level – Moderate, because of marketplace fluctuations.

If you’re a long-term investor, Jio Finance can be a true addition for your portfolio. However, usually seek advice from a financial guide earlier than making funding choices.

Disclaimer:

The information provided in this article is for informational and educational purposes only. It does not constitute financial, investment, or trading advice. Stock market investments are subject to market risks, and past performance does not guarantee future results. Readers are advised to conduct their research and consult with a certified financial advisor before making any investment decisions. The author and publisher are not responsible for any financial losses or decisions made based on the information provided in this article.

Leave a Reply